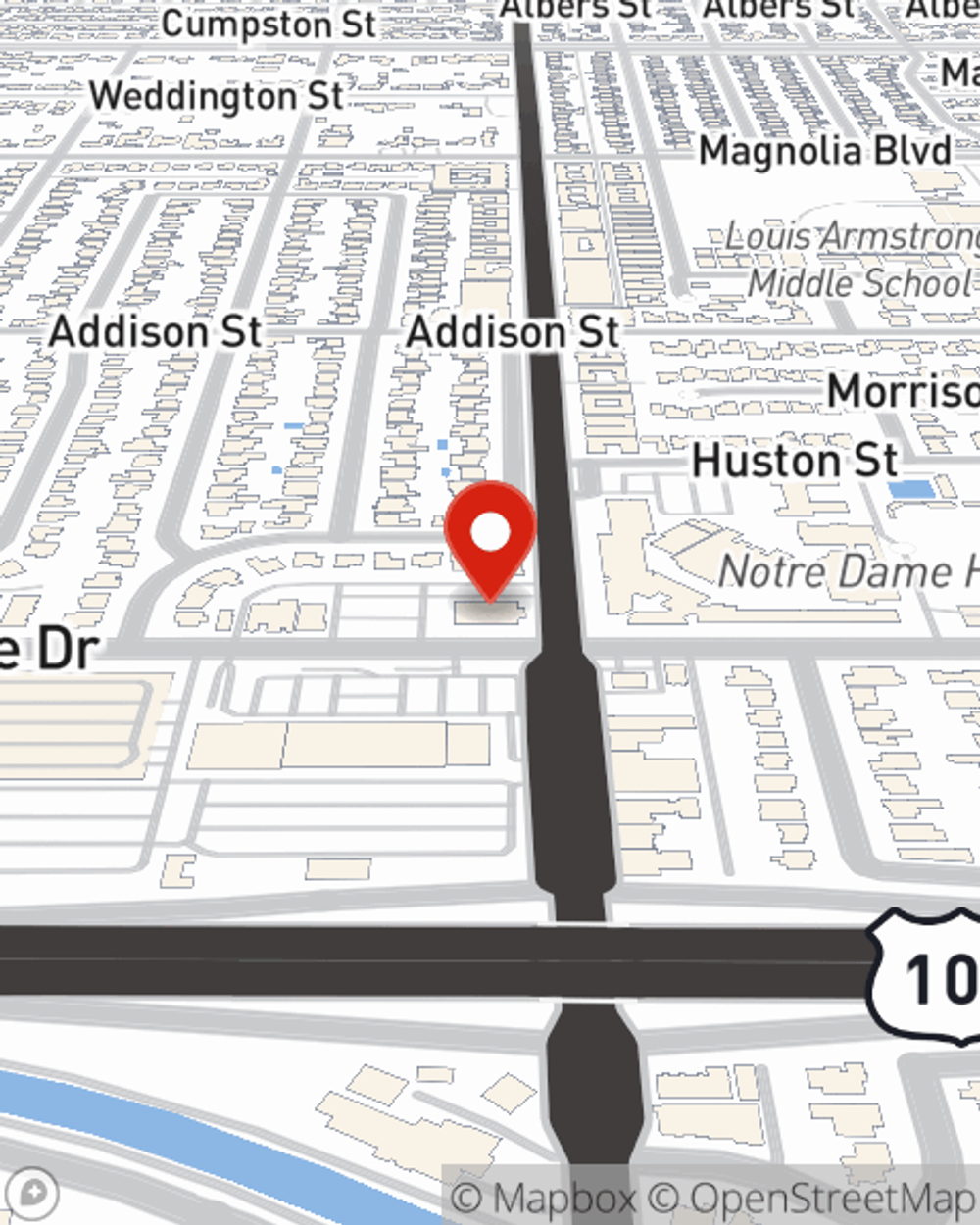

Auto Insurance in and around Sherman Oaks

Take this great auto insurance for a spin, Sherman Oaks

Take this route for your insurance needs

Would you like to create a personalized auto quote?

Insure For Smooth Driving

Why choose State Farm to help you with auto insurance? Lots of reasons! But most importantly, State Farm is the leading provider of auto insurance and offers flexible reliable coverage with a variety of savings options available.

Take this great auto insurance for a spin, Sherman Oaks

Take this route for your insurance needs

Your Search For Auto Insurance Is Over

Terrific insurance as well as multiple savings options are all offered with State Farm. Your coverage can include liability coverage, comprehensive coverage or collision coverage, while your savings options can range from Steer Clear®, Drive Safe & Save™ or the good driver discount. State Farm agent Carlos Cornejo can answer any questions and explain the specific options that may be right for you.

Do you also need protection for your commercial auto or electric and hybrid car? Would you be interested in teen driver coverage or emergency road service coverage? Or are you simply worried about when trouble finds you on the road? State Farm agent Carlos Cornejo offers straightforward attentive care to help address your needs. Call or email the office to get started today!

Have More Questions About Auto Insurance?

Call Carlos at (818) 817-0050 or visit our FAQ page.

Simple Insights®

What is high risk auto insurance?

What is high risk auto insurance?

High risk auto insurance depends on both cars and drivers. Learn how you can lower your car insurance premium with State Farm. Get a quote today.

Carlos Cornejo

State Farm® Insurance AgentSimple Insights®

What is high risk auto insurance?

What is high risk auto insurance?

High risk auto insurance depends on both cars and drivers. Learn how you can lower your car insurance premium with State Farm. Get a quote today.